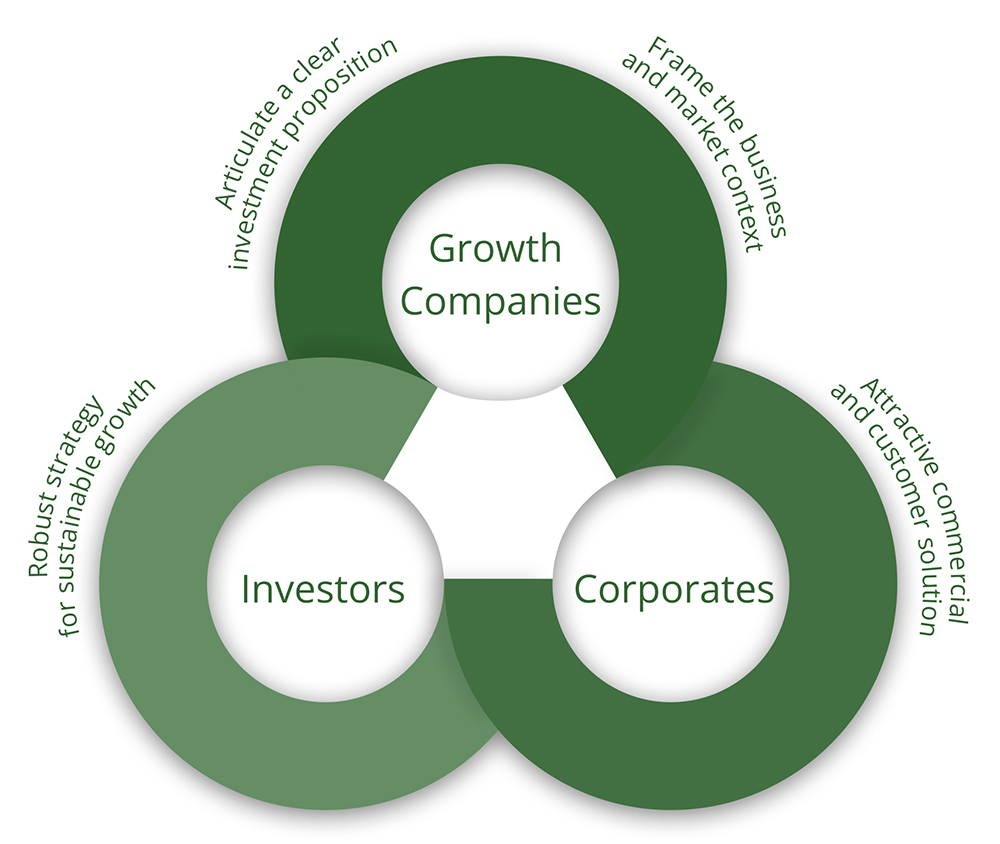

A growing business needs a clear strategy — and a robust business plan to attract capital, partners, and customers. We work with leading growth companies, and major industrial players, around new energy and infrastructure business models to articulate a clear vision supported by a thoughtful, detailed business plan.

Capital is the lifeblood of a growing business. But investment is more than money. It is access to markets and customers, help with product design and development, support for new initiatives. We find investors — who bring much more than money.

Growing businesses need partners — for investment, product development, and expansion to new markets. We have a broad network of corporate, institutional, and investor relationships — to deliver a range of partnership solutions from joint ventures to M&A.

Define and articulate business model, growth ambitions, and robust business plan.

Build strong analytical and documentary foundations to support the investment case.

Create a clear market and strategic framework to position the business clearly.

We have extensive principal investment experience – helping businesses grow as well as

achieving successful exits.

We put ourselves in investors’ shoes to shape our advice.

We help our clients carefully navigate the transaction process.

Holistic approach to evaluating potential investors: fit understanding, commitment, ambition.

Assess commercial and strategic implications of potential investment partners.

Broad approach to transaction structuring including governance, commercial and

stakeholder considerations.

A highly respected intermediary – investors trust LongReach to understand, analyse, and

value new energy businesses.

Through our focus on energy, cleantech and infrastructure, and global network, we have

differentiated access to potential partners.

Experienced and agile across different markets with industrial, financial and strategic players.